Aceloan App Review, Is Aceloan App Legit, Requirements, Interest, Borrow

Aceloan App Review, Is Aceloan App Legit, Requirements, Interest, Borrow

Loan apps have become a popular solution for many, offering convenience and speed. One such app is Aceloan.

This article provides an in-depth review of the Aceloan app, examining its legitimacy, user experience, requirements, interest rates, and more. Without having to take your time, kindly get started now.

Aceloan App Review

User Experience and Hidden Ratings

One of the first things I noticed about the Aceloan app is the lack of visible user ratings and reviews on the Google Play Store.

This absence can be a significant drawback for individuals who rely on these reviews to make informed decisions.

The hidden ratings raise questions about the transparency and reliability of the app. Users often feel more confident when they can see feedback from others who have used the service.

Interface and Usability

Despite the hidden ratings, the Aceloan app boasts a user-friendly interface.

The application process is straightforward, and users can navigate through the app with ease.

However, the lack of visible reviews can overshadow these positive aspects, leaving potential users skeptical about the app’s overall reliability.

Read: New Credit Loan App Review: Is New Credit Loan Legit? (Honest Review)

Is Aceloan App Legit?

Regulatory Approval

A crucial factor in determining the legitimacy of any loan app is its approval by relevant financial authorities.

In Nigeria, the Central Bank of Nigeria (CBN) is responsible for regulating financial institutions, including loan apps. Unfortunately, Aceloan is not approved by the CBN, which raises significant concerns about its legitimacy.

Transparency Issues

The act of hiding user ratings and reviews further complicates the legitimacy question.

Transparency is a key component of trust in financial services, and the lack of visible feedback can be seen as a red flag.

Users are left wondering why the app developers chose to hide this information and what they might be trying to conceal.

Should I Borrow Money from Aceloan?

Pros and Cons

Borrowing money from Aceloan comes with its set of advantages and disadvantages. On the positive side, the app offers quick access to funds, which can be crucial in emergencies.

The application process is simple, and users can receive their loans within a short period.

However, the cons outweigh the pros. The lack of CBN approval and hidden user reviews are significant drawbacks.

Additionally, the app’s interest rates and terms are not clearly disclosed, making it difficult for users to understand the true cost of borrowing.

Alternatives

Given the concerns surrounding Aceloan, potential borrowers might want to consider alternative loan apps that are transparent and approved by the CBN.

These alternatives often provide clearer terms and conditions, along with visible user feedback, helping borrowers make more informed decisions.

Aceloan Requirements

Eligibility Criteria

To apply for a loan through the Aceloan app, users must meet certain eligibility criteria. These typically include:

- A valid means of identification (e.g., national ID, driver’s license, or international passport)

- Proof of income (e.g., pay slips or bank statements)

- A valid bank account

- An active phone number and email address

Documentation

Applicants are required to provide various documents to verify their identity and financial status.

This documentation helps the app assess the borrower’s ability to repay the loan. However, the lack of transparency about the app’s approval process can make users wary of sharing their personal information.

Aceloan Interest Rate

High Costs

One of the most critical aspects of any loan is the interest rate. The research I conducted also shows that this loan app claimed their interest rate is 0.05 per day and loan term ranges from 30-90 days but unfortunately, these aren’t the truth.

Their loan term ranges from 7-14 days.

Comparison with Other Apps

When compared to other loan apps, Aceloan’s interest rates are often higher. This makes it less attractive to borrowers who have other options available. Transparent loan apps usually provide clear information about their interest rates and fees, allowing users to make better financial decisions.

Aceloan App Download

Availability

The Aceloan app is available for download on various platforms, including the Google Play Store.

However, potential users should exercise caution due to the concerns mentioned earlier. Before downloading, it’s essential to consider the app’s lack of transparency and regulatory approval.

Installation Process

Downloading and installing the Aceloan app is a straightforward process. Users can find the app on the Google Play Store, click the download button, and follow the on-screen instructions to install it on their devices.

Once installed, users can create an account and start the loan application process.

Aceloan APK Download

Risks of APK Files

Some users might prefer to download the Aceloan APK file directly from third-party websites. While this can be an alternative way to access the app, it comes with significant risks.

APK files from unofficial sources can be modified to include malware or other malicious software, putting users’ personal information at risk.

Safe Download Practices

To ensure safety, users should only download APK files from trusted sources. It’s also essential to have a reliable antivirus program installed on their devices to scan for potential threats.

However, given the concerns about Aceloan’s legitimacy, it’s advisable to avoid downloading the APK file altogether.

How to Apply for Aceloan

Step-by-Step Guide

Applying for a loan through the Aceloan app involves several steps:

- Download and Install: Download the Aceloan app from the Google Play Store and install it on your device.

- Create an Account: Open the app and create an account by providing your personal information, including your name, phone number, and email address.

- Verify Identity: Upload the required documents to verify your identity and financial status.

- Apply for a Loan: Select the loan amount you need and submit your application.

- Wait for Approval: The app will review your application and notify you of the decision. If approved, the loan amount will be disbursed to your bank account.

Tips for a Successful Application

To increase the chances of a successful loan application, ensure that all the information provided is accurate and up-to-date.

Additionally, having a stable source of income and a good credit history can improve your chances of approval.

Aceloan Customer Care

Contact Information

For users who need assistance or have questions about their loans, Aceloan provides customer care support. However, the contact information is not always readily available, which can be frustrating for users.

Customer Care Number

Users can reach Aceloan customer care by calling the following number: +2347073211487. It’s essential to have your account details ready when calling to expedite the process.

Email Support

For less urgent inquiries, users can contact Aceloan via email at aceloan_cs@aceloanapp.com. Email support can be useful for detailed questions or issues that require documentation.

Office Address

As of the time this article was written, Aceloan didn’t provide their office address.

FAQs On Aceloan App Review, Is Aceloan App Legit Or Not

Here are some helpful frequently asked questions on Aceloan app review, is Aceloan App legit or not with their respective answers:

Is Aceloan App Legit and Trusted?

No, the Aceloan app cannot be considered legit or trusted. It is not approved by the Central Bank of Nigeria (CBN), which raises significant concerns about its legitimacy.

Additionally, the app hides user ratings and reviews on the Google Play Store, which further undermines trust and transparency.

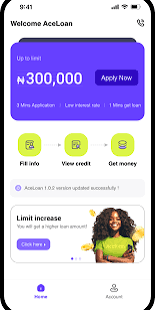

How Much Can I Borrow from Aceloan App?

The loan app claimed you can borrow up to N300,000.

Is Aceloan App Legit or Scam?

Given the lack of CBN approval and the hidden user reviews, the Aceloan app raises several red flags.

While it may not be a scam in the traditional sense, its lack of transparency and regulatory approval makes it a risky choice for borrowers.

What Are the Aceloan Requirements?

To apply for a loan through the Aceloan app, users generally need to meet the following requirements:

- A valid means of identification (e.g., national ID, driver’s license, or international passport)

- Proof of income (e.g., pay slips or bank statements)

- A valid bank account

- An active phone number and email address

What’s Aceloan Interest Rate?

0.05 per day as claimed.

How Do I Download Aceloan App?

The Aceloan app can be downloaded from the Google Play Store. Here are the steps to download it:

- Open the Google Play Store on your Android device.

- Search for “Aceloan.”

- Click on the app and then click the “Install” button.

- Follow the on-screen instructions to complete the installation.